Electronic Bond Trading Platforms

By Hayley McDowell. Evidence predominantly suggests that electronic trading platforms bring advantages to investors by lowering transaction costs.

Trading Platform Overview Types How To Choose

As a major global electronic platform for sovereign debt Tradeweb had its most active month by daily trading volume in March which was up by 415 YoY reaching USD 1trillion.

Electronic bond trading platforms. According to Greenwich Consulting in March 2020 electronic trading of US Treasury bonds reached an average daily record of USD540 billion up by 25 YoY. One Minute Profit Signal Indicator is intended for trading on the M1 timeframe with expiration of 1 minute 60 seconds. The ETP is the centralised price and trade repository and dissemination for the primary and secondary bond market.

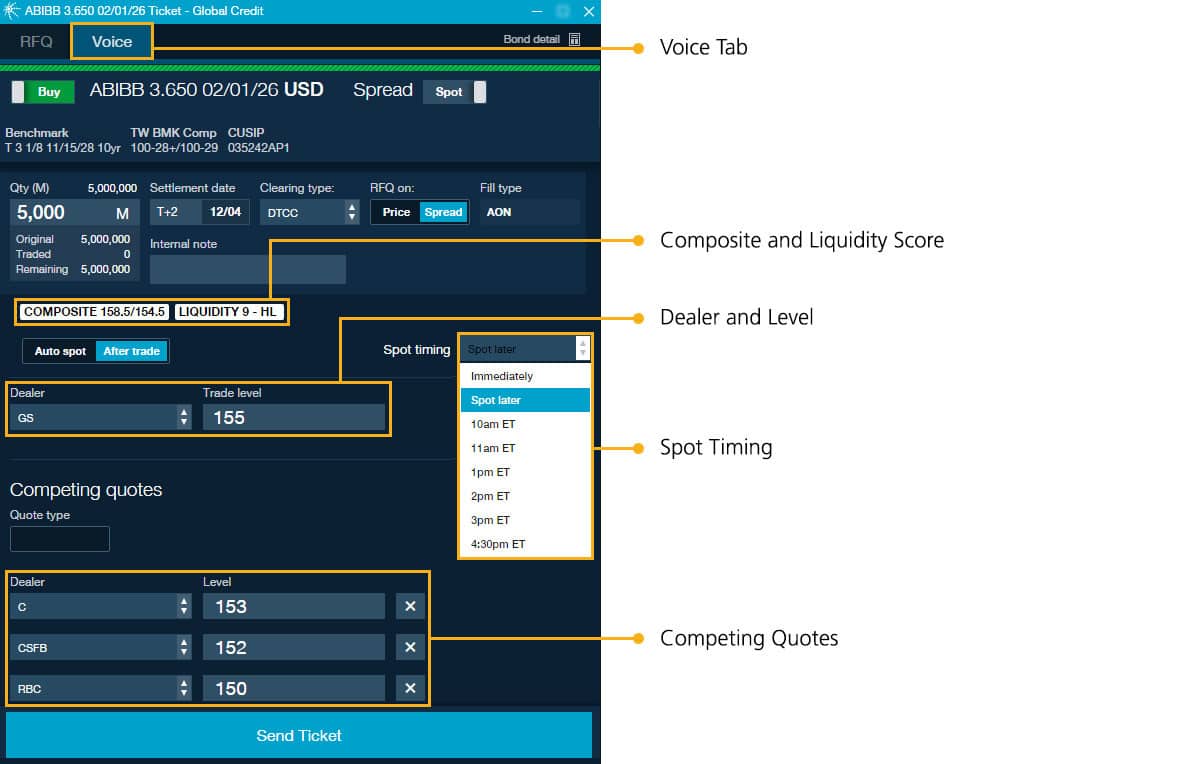

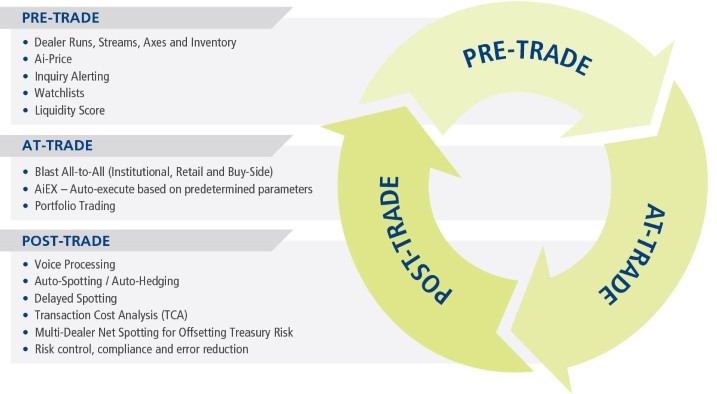

Electronic Bond Trading Review. Structure evolution - where the life- cycle may lead. In this primer from SIFMA Insights we attempt to define electronic trading by providing an overview of the types of platforms and strategies utilizing a form of electronic trading.

BlackRock announced plans in April 2012 to launch a crossing sys-tem called Aladdin Trading Network. There is relatively little research specific to fixed income markets but lessons can be drawn from other asset classes. Highlights from the primer include.

For example Ohio issued a variable rate muni bond last year using ClarityBidRates electronic trading platform to reset the rates. Issuers can also benefit from the use of electronic trading platforms to more efficiently price their offerings. Second Revolution In Electronic Bond Trading Gareth Coltman global head of automation at MarketAxess the electronic platform for fixed income trading and reporting said the industry is going through a second revolution which will lead to radical changes in market structure.

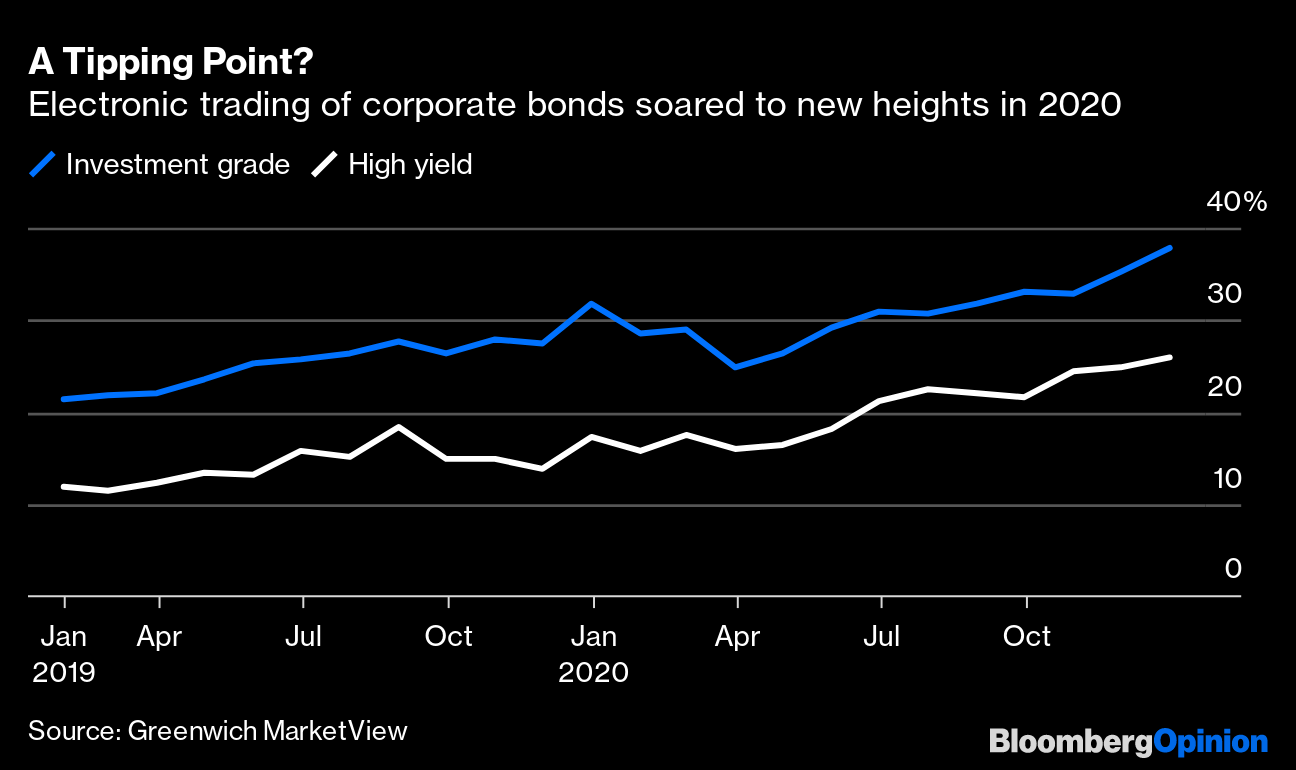

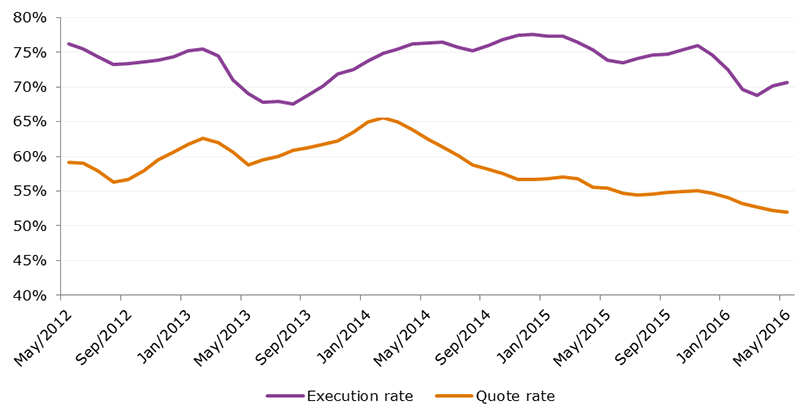

Electronic trading tends to have a positive impact in terms of market quality but there are exceptions. ETP is the acronym for Electronic Trading Platform. Bond markets have for years been seemingly close to a tipping point when it comes to electronic trading yet they could never quite break through.

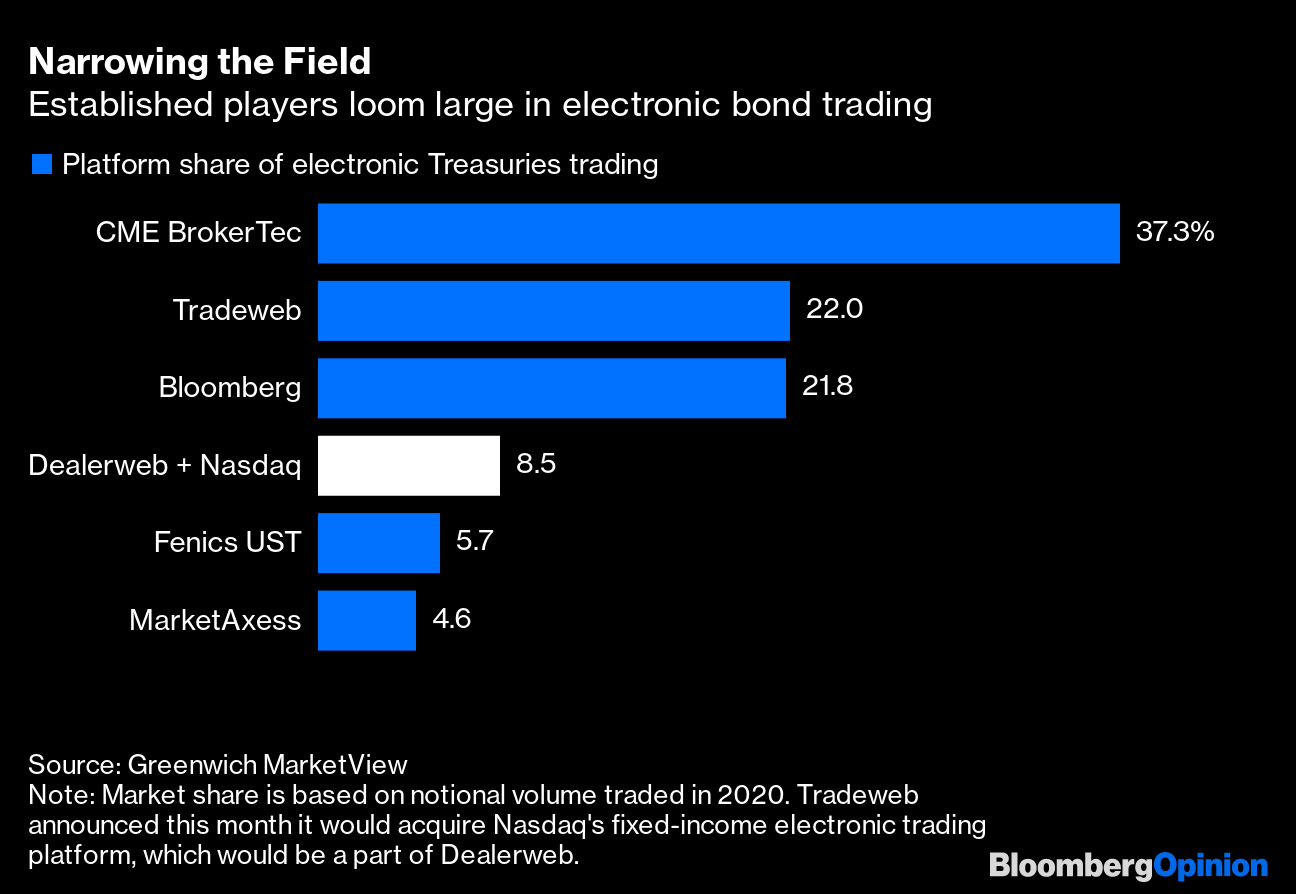

One of the biggest winners from this shift is MarketAxess the largest electronic bond trading forum which has seen the average monthly volume of bonds traded across its platform more than double. Electronic trading platforms on the liquidity efficiency and resiliency of the corporate and municipal bond markets. Electronic trading platforms for corporate bonds face consolidation in the US despite a surge in trading volumes executed in 2018 new research suggests.

Electronification of the old market structure - Market size and trends today. In April 2013 it announced a new plan for the sys-temunder which it would team up with MarketAxess Holdings itself the operator of a corporate bond e-trading platformIn June. Kraken is electronic bond trading platform South Africa a cryptocurrency exchange.

Are subject based on differences in trading protocols or business models. Why Market Structure Matters Given the need for market liquidity and minimized trading costs market structure matters. Electronic bond trading platformAverage daily trading volume on Tradeweb Markets Incs online bond trading platform topped electronic bond trading platform 1 trillion in January the company announced Thursday.

Have announced or launched new e-trading platforms and systems. Bloomberg is one of the main players. Liqidnet ITG Electronifie and Bondcube have also developed.

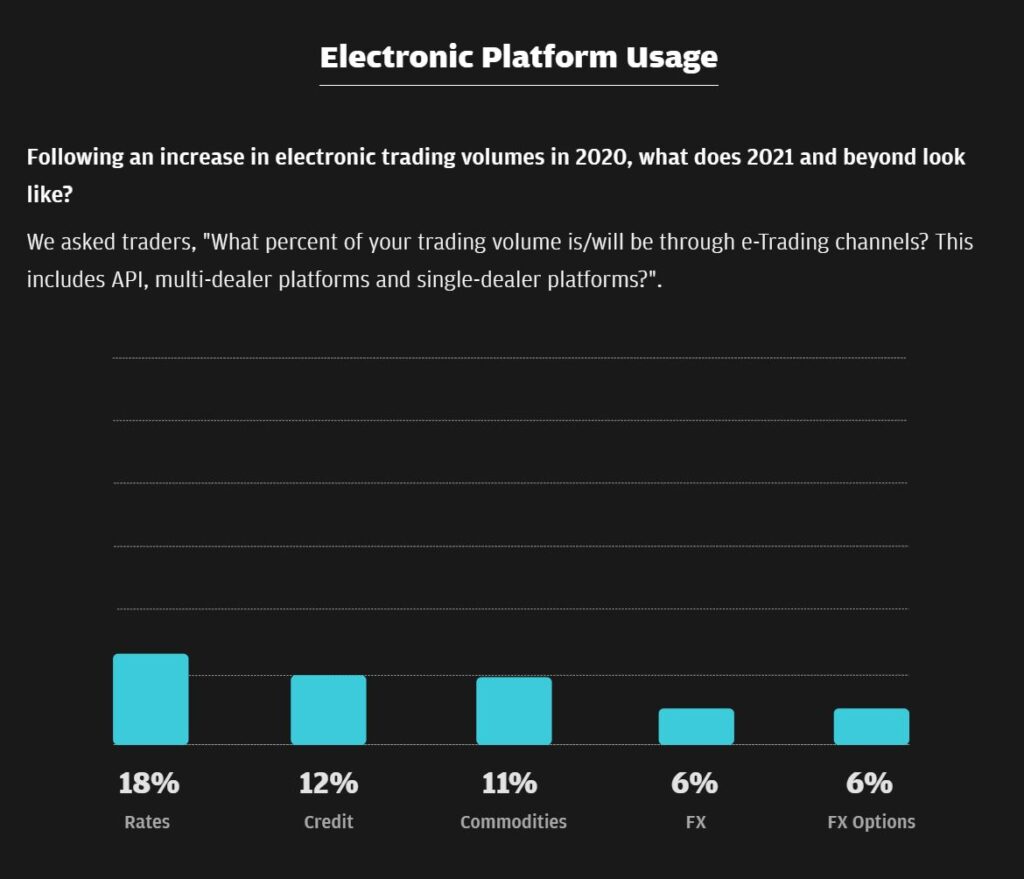

Between November 2016 and January this year 14 new fixed income trading platforms joined the market according to a recent blog post by John Greenan a front office. It is an efficient and facilitative market control system for Bursa Malaysia to supervise the bond market. A report from Greenwich Associates has said that electronic trading levels increased to 26 of the total US corporate bond trading volumes in the third quarter last year up from just 19 in the first quarter.

One early issue the Subcommittee identified is the varying regulatory treatment to which credit and municipal bond trading platforms in the US. A busy start to the year in bond trading has led to record volatility electronic bond trading platform at electronic marketplaces. As of January this year there are 128 trading platforms available for fixed income trading suggesting the explosion of new bond venues is yet to slow down.

Slowly at first and lately more quickly the corporate-bond market is embracing trading on electronic platforms.

Bond Traders Prefer To Pick Up The Phone For Portfolio Deals

The Bond Trading Revolution Is Real This Time Bloomberg

Examining Corporate Bond Liquidity And Market Structure

The Bond Trading Revolution Is Real This Time Bloomberg

Bond Trading Technology Finally Disrupts A 50tn Market Financial Times

Electronification And The Tech Revolution In Credit Trading Markets Media

Bond Trading Finally Dragged Into The Digital Age Financial Times

Bond Trading Technology Finally Disrupts A 50tn Market Financial Times

Electronification And The Technology Revolution In Corporate Bond Trading

New Evidence On Liquidity In Uk Corporate Bond Markets Fca

Bloomberg Launches Trading Platform For Bonds In Mauritius Press Bloomberg L P

Https Www Newyorkfed Org Medialibrary Media Research Staff Reports Sr938 Pdf

E Trading Us Corporates The Platform Renaissance Tabbforum

What All To All Bond Trading Is And Why Volumes Are Surging

Bond Trading Technology Finally Disrupts A 50tn Market Financial Times

Jp Morgan Rates And Credit Trading Show Greatest Electronic Growth The Desk Fixed Income Trading

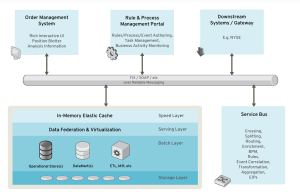

Design And Architecture Of A Real World Trading Platform 2 3 Vamsi Talks Tech

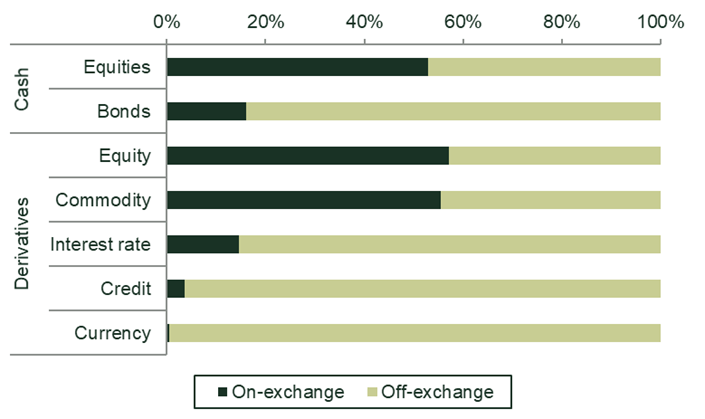

Shining The Light The Merits Of On Vs Off Exchange Trading Oxera

The New Kings Of The Bond Market Financial Times

Posting Komentar untuk "Electronic Bond Trading Platforms"